Blog

How Does Workmen’s Compensation Work in California

Many Californians are injured at work on a daily basis, but do not understand how does workmen's compensation works in California. Most employees just want to work and support their families. But many jobs are either dangerous or because of the repetitive nature of...

Are volunteers covered under workers compensation in California?

Volunteers are an incredible asset for businesses and non profits. Apart from from the sense of satisfaction one feels from pitching in to help local businesses or serving your local community. Serving as a volunteer is a great way to gain valuable skills and...

Are interns covered under workers compensation?

Most employers do not realize that in the past couple of years the Federal and California rules have changed regarding the use of unpaid interns. What this means to the intern is that if your employer has followed the rules then your internship would be unpaid...

Are Workers Compensation Benefits Taxable in California?

Have you been wondering, are worker's compensation benefits taxable in California? If so, then this article will explain that in most cases these benefits are not taxable, but there are some exceptions as described below. Obligation of employers and what it covers It...

Who Pays Workers Compensation In California?

Every institution, individual or company in California that employs workers must have workers' compensation insurance or be self insured. It is for the protection of the employer and employee in the case an employee is injured in the line of duty. If you are injured...

New Traffic Laws for 2021

The following changes to public safety and driving laws for California residents and drivers that you should know about: Effective January 1, 2021: Assembly Bill 2717, which goes into...

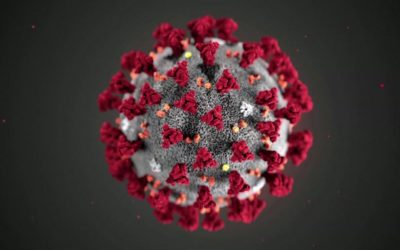

Covid-19 Workers’ Compensation claims just got easier

On May 6, 2020 Governor Newsom signed an executive order that provides immediate relief to all essential workers who have been or will be diagnosed with COVID-19 during the covered period. The order enacts a rebuttable presumption that presumes a worker filing a...

Coronavirus and California Workers’ Compensation, What You Need To Know

Coronavirus (COVID-19) and California workers’ compensation, what you need to know. Workers’ compensation benefits are available if you contract coronavirus at work. As with any other work injury you will need to prove that you contracted the coronavirus during the...

Are you ready for the new cell phone law AB-1785

January 1, 2017 AB-1785 becomes effective in California. Under the new law drivers will no longer be allowed to hold their cell phones in their hands for any reason, including using any of a phone’s apps, such as music playlists or maps. Under the new law, drivers can...